We’re going to go ahead and assume you already know what a bullet journal is. They’re big business at the moment. Even those of us who’ve never kept one have a pretty good understanding of them. They’re fantastic tools for organizing your life and making plans look pretty at the same time.

And, bullet journaling could be the answer to your ongoing debt problems. Clearing debt is, after all, about managing different areas of your life. Sounds like bullet journals to us! And, if you’re already successfully implementing the bullet journal method into your life, you’re halfway there. Read on to find out how that can help with your debts.

Organization = getting on top of debts

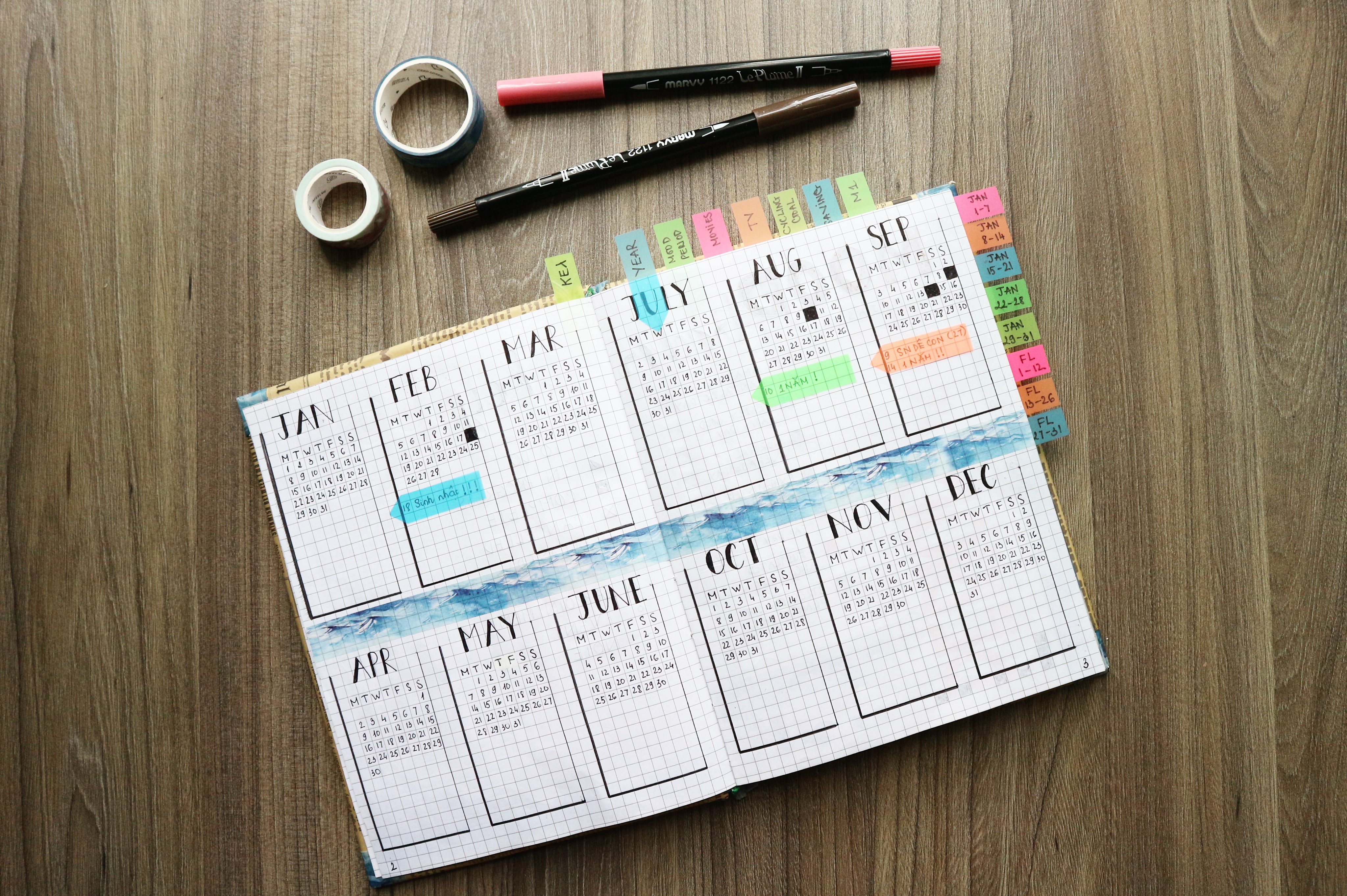

When you’re trying to clear debts which keep building, organization is the best hope you have. After all, once your debts start snowballing, it’s likely you’re collecting them from more than one place. As such, focusing on your original debt will allow other expenses to spiral out of control. Fear not. Bullet journals and organization go together like…well, bullet journals and organization! Dedicating journal pages to this cause can help you keep track of each debt, and payment dates for them all. You may want to put this straight into your journal, or use something like this debt snowball excel as an easy way to outline everything, then transfer or print the essentials. Either way, writing all this stuff down, and being able to look at it when you need to, will make a massive difference. You could even use your journal to predict when you hope to be debt-free. That light at the end of the tunnel should be all the motivation you need.

Bill management = making sure things don’t get worse

When we’re paying off debts, it’s all too easy to become one-track-minded about where our money is going. After all, that’s your primary focus. But, remember what we said about snowballing? It’s crucial you keep on top of your other bills at the same time. And, budgeting for them here can help you do just that. You’ll be able to jot down which dates you need to pay what bills by. It’s worth sitting down at the start of each quarter and dedicating time to this. It may even be worth writing reminders for the weeks before bills are due. That way, there won’t be any unpleasant surprises, and you can keep on top of other payments, even when paying your debts.

Time management = faster clearance

Bullet journals are also fantastic at helping you to make better money as they allow you to keep on top of time management. The more hours you find in the day, the more side hustles you can take on board. And, the more side hustles you have behind you, the more money you’ll have to put towards your debt fund. As such, you stand to clear it sooner than you would have otherwise. All because you bit the bullet with that journal.

Comments are closed.