Being in control of your finances can give a sense of empowerment and relief in the same way that having absolutely no control because things have got out of hand can cause you huge amounts of stress and and anxiety – two of the biggest contributing factors to depression.

Getting out of and staying out of debt can be extremely hard if you’ve got yourself into a bit of a pickle, but there are things that you can start doing right now that will help relieve many of your financial woes in the long run.

- Put some money aside whenever you can

Try to stick to saving something every week or every month (whichever you decide). This is especially good for those of you who end up with absolutely nothing in their bank account by the end of the month. Having money saved each and every month will mean that you can get a good back up fund made which you can use for emergencies. You never know when you’re going to need it – your car might break down and you don’t want to be in a situation where you can’t make it to work as that’s going to do anything but help you get a grip on your finances. Try allocating at least twenty percent of your income toward your financial priorities.

- Give yourself reminders so you don’t fall behind

You don’t want to forget to pay your bills on time as that can have a detrimental effect to your credit score – something you really don’t want happening any time soon. If you do already have a bad credit score then there are things that you can do to improve it but it will take time. It cannot be changed overnight but if you start now, it’ll steadily start to improve. Boost your credit rating with these simple steps.

- Budget like a badass

You need to make sure you learn to budget your money well as that’s the biggest way to keep control of your finances. Work out an effective budget that you can stick to on your salary with your specific outgoings. By doing this you will be able to keep on top of all of your monthly outgoings and know exactly what you can spend vs what you simply cannot.

- If you have loans all over the place, condense them

Obviously, being in debt is never a good thing and we’re not about to suggest that you go getting loans just because you can, but if you’re struggling to maintain control because you have loans coming out of your ears then it’s good idea to take out one big loan, to have it all underneath one umbrella and that way you’ll know what you’re doing and you’ll only be paying interest on one loan rather than multiples. Make sure that you condense your debts with a trusted cashfloat direct lender.

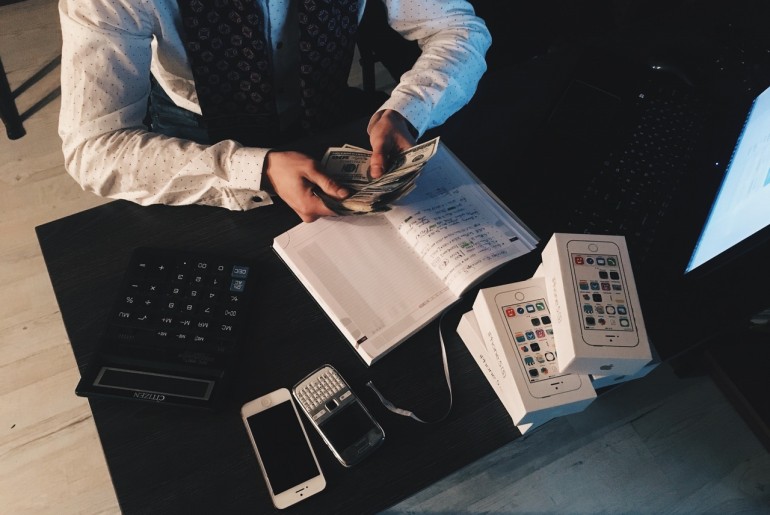

- Try splashing the cash rather than using credit

If you consistently overspend each and every month then perhaps it’s time that you started to spend money using cash. It’s easy to overspend when you can’t actually see the amount in front of your eyes which is why credit cards can be dangerous.

- Allocate around 30% of your income for your lifestyle

Obviously you’re going to want to spend some money as you’ve worked hard to earn it. But that doesn’t mean you should go totally overboard either. Once you’ve paid off all your bills, take about 30% to spend on all the things you like to do socially – we’re talking restaurants, cocktails with the girls, film nights and so on. This way you’re not having to go without which means you’re far more likely to stick to saving your cash as well as splashing it.

- Have money goals to aim towards

You need to set specific financial goals to ensure you stick to all of the above. What do you want to achieve by taking control of your finances again? Do you want to pay off all of your debts or just get your head above water again? You also need to bare in mind how much you want pay in a certain amount of time. If you have a lot of debt then you need to factor that into your plans as these things take time, commitment and dedication. One way to do this is to have mini money goals to work towards that you will be able to meet. It will keep you motivated as if you are too far away from goals, you’re less likely to stick to them and far more likely to throw in the towel.

Comments are closed.