Bad habits are hard to break, particularly when you are accustomed to doing things a certain way. Unfortunately, bad behavior has consequences, so repeating the same missteps, again and again, eventually catches-up with you. With your personal economic stability at stake, bad financial habits can have a drastic impact on your overall financial health.

Whether you are struggling to make ends meet or unhappy with your progress toward major financial goals, money management issues may be to blame. Correcting a few bad habits may be all that’s needed to turn things around, so boosting financial security starts with a look at the way money flows through your hands.

Common Money Missteps

Are you getting by with little to spare each month – even though you bring-in a healthy income? Do you continue to lose ground, sliding further into debt? Are long-term savings goals suffering, because your entire paycheck goes toward more immediate monetary obligations?

If you answered “yes” to any of the questions above, a few bad habits may be holding you back. Consider these common concerns, as you put your personal financial habits to the test:

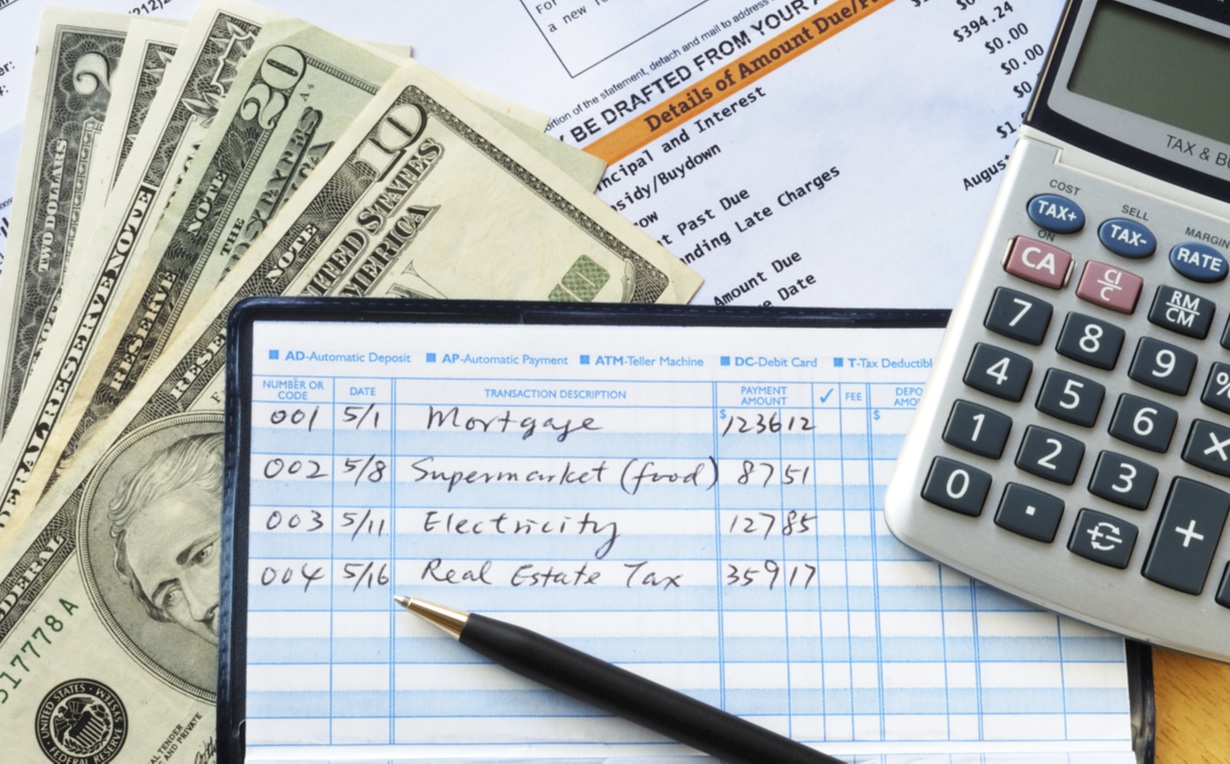

Impulse buys – Discretionary spending covers a wide range of purchases, which are subject to personal judgement. Unlike recurring expenses, such as rent and house payments, discretionary budgets vary, according to purchases you make every day. If you are serious about stabilizing your budget, start with a close look at impulse spending. As you track discretionary purchases, you’ll begin to see patterns, illuminating your (sometimes bad) money handling habits. For the best results, establish a waiting period, delaying purchases until you’ve had time to think them through. You should also compare prices online; while everyone knows about review sites, you should also think about spoofing or hiding your IP location to find better deals overseas. Restraining your discretionary spending yields immediate savings, which ultimately strengthens your household budget.

Minimum payments – Regardless of where you hold debt, repaying as slowly as possible ends-up costing more money. Consider credit card monthly minimum payment amounts, for example, which often reflect only a portion of accrued finance charges. In theory, that means you can pay the minimum requested payment, without adding addition charges to your card, and still watch the balance climb beyond affordable levels. To eliminate debt in a timelier manner, construct your own repayment schedule, and freeze credit card spending as you reduce debt to affordable levels.

Waste – Standard living costs comprise the bulk of most family budgets, including housing, food, transportation and other essentials. Although you can’t make these expenses disappear, many household budget categories yield room for savings – just by eliminating waste. Pare these areas to improve your financial outlook:

- Energy spending – Managing your thermostat and turning off lights when you leave the room are two easy ways to reduce energy use. For further savings, unplug electronic devices when not in use, take shorter showers, and tighten-up your motoring habits to burn less petrol.

- Food costs – Spoiled and uneaten food are a waste of money, eating-up resources you can’t afford to squander. Planning meals and shopping to a list reduce food waste, freeing financial resources for other obligations.

- Unused subscriptions – From television services to health club memberships, consumers waste vast sums on unused subscriptions. To avoid overpaying, review memberships and service plans, with an honest eye toward cutting wasteful connections you no longer need.

Costly credit – Debt is a sometimes touchy, but absolutely necessary aspect of personal finance. From credit cards to long-term mortgages, various types of consumer credit serve diverse needs, helping families achieve their financial goals. Used with discretion, access to credit opportunities is enabling, but some costly forms of debt can become a burden. To avoid the cumbersome cost of expensive debt, it is important to review your options and settle on the most cost-effective borrowing alternatives. A high APR credit card, for instance, is not a long-term financing solution – particularly when low-interest loans may be available to fund your instalment financing needs. To avoid high credit costs, review and compare lending options online, before making commitments.

Correcting bad habits yields immediate financial gains, stabilizing your personal economy and reinforcing your long-term security. By exercising spending discretion and steadily repaying debt, you’ll improve your financial outlook, which also benefits from waste reduction efforts and responsible use of credit opportunities.

Comments are closed.