Saving money is essential. And even more so in a world that’s financially unstable and rather crazy when it comes to the huge range of super-offers on almost any item the mind can conceive.

I like to think of myself as a financially savvy person – without making myself feel like I lack all the good things in life. To make sure I have enough money to survive, to save and to satisfy my little pleasures, I use certain money-saving hacks – and I have shared with you my favorite ones right below. Read on and find out more.

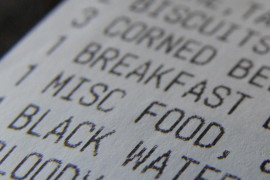

The shopping list

OK, this is an all-time classic everyone will advise you to do. But do you know why it’s so popular with frugal living advocates?

Because it works.

I never go grocery shopping without a carefully constructed shopping list. It helps me stay on track, it helps me get the things I really need and it also helps me “hunt” those real offers – not the ones that are only marketed as discounts, but don’t make much of a difference.

Before I leave home, I analyze my cupboards and my refrigerator, I take a look at my storage room and I carefully consider which are the items I need. And I only go for those that I really need, not just want.

The end of season discounts

Like everyone out there, I like to look good. But I don’t usually splurge on clothes, makeup or hair products that are sold in full season. Most of the times, I am very careful about the end of the season discounts because I know I will find a lot of great things there for a fraction of the price I would pay at the beginning of the season.

The secret to staying fashionable and frugal is to choose discounted clothes and products that are going to be in the next year as well – like a biker jacket or a pair of jeans that will not go out of fashion before I even get the chance to wear them.

I think long and hard before making a large purchase

Impulse buying is one of the worst enemies of any frugal living. You see something, you realize you may actually need it, and you want it there and then.

That’s a complete no-no for me, especially when it comes to larger purchases (such as a new phone or a new laptop, for example). Before I jump into clicking the “buy” button, I take about one month to think things through.

If, after one month, I still want and need that particular item, I buy it. But not before I carefully analyze its advantages, its disadvantages and the stores at which I can get the lowest price possible. Sometimes, I change my mind during that one month and decide I don’t really want to spend a lot of money on that item. Other times, I realize I want it, I do my math and I invest in it.

Comments are closed.